Maternity Leave Checklist for Canadian Physician Assistants

Preparing for maternity leave involves more than just understanding the legalities.

It requires effective communication with your employer, planning your workload, and taking care of yourself throughout the process.

Here, we’ll provide insights on how to inform your employer, navigate workplace policies, and create a comprehensive transition plan. We'll also discuss the financial considerations and available support to help you manage your finances during your time away.

Congratulations! You’re Expecting!

Or maybe you’ve got babies on your mind and are starting to plan ahead. Either way, you’ve come to the right place for all you need to know about planning and preparing for parental leave from the moment you find out you’re expecting to your first day back on the job!

I. Overview of Parental Leave for Canadians

In Canada, both parents are entitled to parental leave, which includes maternity and paternity leave.

Maternity leave is a term often associated with mothers, but it's crucial to recognize the importance of paternity leave as well. Paternity leave allows fathers or partners to take time off work to care for and bond with their new child.

The Government of Canada provides employment insurance (EI) benefits for maternity leave.

Under these policies, you are entitled to take up to 12 - 18 months of maternity leave with job protection.

II. How much will I receive?

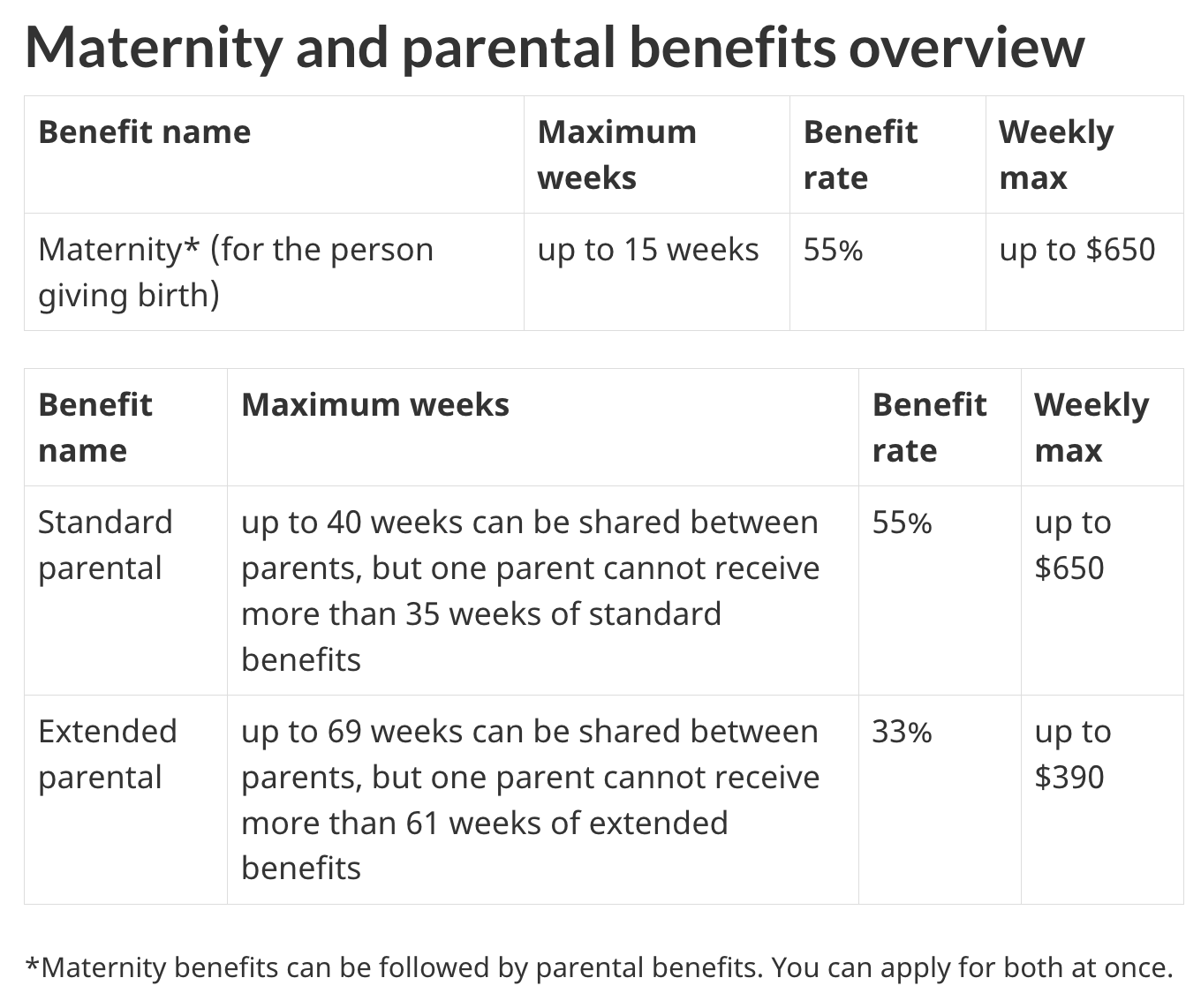

In Canada, you will receive 55% of your earnings, up to $650 CAD per week.

According to Service Canada, expectant mothers can start to receive Maternity Employment Insurance (EI) benefits up to 12 weeks before their due date. You may decide to stop working early if you are having an especially difficult pregnancy, the nature of your work is demanding or you’d like some extra time to prepare for the arrival of your baby. Alternatively, you may decide to work as long into the pregnancy as possible to give you more time at home once the baby arrives.

With regards to parental leave, in total, you can take up to 12 months off at the current benefit rate (55% of your insurable earnings) or up to 18 months off at a reduced rate (33% of your insurable earnings). You can share parental leave with your partner so you each have a chance to spend time caring for and bonding with your baby at home.

When deciding how much time to take off, you will need to sit down with a budgeting tool and crunch some numbers. You’ll also need to consider your lifestyle preferences, how much value you place on time spent at home with your little one and how much you are willing to sacrifice in terms of luxuries and extras if you are faced with a reduced income. It’s not an easy decision, so give yourself some time to weigh out the pros and cons and come up with a reasonable plan.

Some employers (such as hospitals) offer salary “top-ups” to supplement the basic income provided by EI benefits.

Private physicians’ offices do not typically have such plans in place, but it doesn’t hurt to ask. The plans are very easy to implement and do not have to be registered as long as there is an adequate paper trail of the funds. The not-so-easy part: convincing your employer to top you up to 100% when he/she may also have to pay the salary of a temporary PA while you’re away. You may have more luck asking for a partial top-up, perhaps up to 75% of your salary.

Another source of income while you’re on parental leave is the Canada Child Benefit.

You can use this calculator to help you figure out how much you’ll be entitled to. Even if you feel that you’re a high-earner, you should still apply, as you may be eligible for some funds. For example, if a family consisting of two working PAs (who earn $85000 each/ year) and a baby, the Canada Child Benefit amount would be about $50 per month, which doesn’t seem like a lot, but would certainly help with recurring expenses like diapers and wipes.

A final word about benefits: you are still eligible for your regular health/dental benefits throughout your parental leave. This does not affect your EI benefits and you should remind your employer to continue to pay the premiums for your health plan so you don’t lose access to your coverage.

III. Preparing for Maternity Leave: Checklist and Timeline

We recommend starting the process for preparing for Maternity Leave several months before your baby is born.

Here is a checklist of how to prepare for your Maternity Leave:

Inform Your Employer: The Canada Labour Code advises that you must give your employer written notice at least four weeks before beginning either maternity or parental leave. The notice must advise the employer of the intended length of leave.

It's generally recommended to inform your employer about your pregnancy as soon as you feel comfortable doing so. This allows them ample time to plan for your absence and make necessary arrangements (including hiring another PA to take over during your maternity leave).

Your last day of work can be your estimated delivery date (EDD), or a few weeks prior to your anticipated delivery date.

Review the company’s Maternity Leave Policy:

Information or link to Complete the hospital’s Maternity Leave Application (if applicable)

Requirement for a Doctor’s letter submitted to your manager

Instructions or further information on how to continue benefits, pension (e.g. HOOPP), and top-up pay (if applicable)

Information on outstanding vacation prior to your leave

Request your Record of Employment (ROE): In order to receive EI benefits, you must submit your Record of Employment (ROE) to Service Canada. A Record of Employment (ROE) is often issued after your maternity leave begins, which will be submitted to Service Canada. Otherwise you can visit My Service Canada Account (MSCA) to view ROEs issued by past and recent employers.

Note: Some employers don’t have experience with issuing the ROE and will need to consult their payroll/ accounts person to create one. Some have not set up their online accounts for direct submission of the ROE and will need to issue a paper form. And sometimes, even large institutions with experienced HR departments have mix-ups that may cause a delay in the processing of your ROE.

Let them know early on that you will be needing the ROE on your last day and make sure to follow up on the request until it is fulfilled. There is already a waiting period before EI benefits are paid out so don’t stretch this out any longer by not having the right paperwork.

Submit Documentation to HR: Check with your employer or human resources department regarding any specific documentation they may require, such as a doctor's note or a formal letter outlining your maternity leave plans.

Complete your Employment Insurance Application for EI Benefits during your Maternity Leave: This is an online application that is recommended you complete right away. Documentation can always be submitted after the fact.

IV. Planning for your Absence

We strongly encourage PAs to work with their employers to help with hiring and onboarding a PA to take over for your responsibilities during your maternity leave.

Identify the Hiring Need: Determine the scope of work that needs to be covered during your maternity leave. It may be useful to have the PA start BEFORE you leave for maternity so that you have overlap and an opportunity to orient and mentor the PA to the position.

Post the PA position: Typically maternity positions are advertised as “Temporary, Full Time for 12-18 months” with a start date that takes place PRIOR to your maternity leave. Click here to learn "How to Write a PA Job Posting”.

Review Resumes and Conduct Interviews: Screen the resumes received and shortlist candidates who meet the necessary qualifications. Conduct interviews to assess their skills, experience, and fit with the role. Prepare a list of questions that address their ability to handle the specific responsibilities of your position.

Check References: After the interviews, contact the references provided by the candidates to gather additional insights about their work ethic, reliability, and ability to handle the responsibilities of the role. This step helps validate the information provided and ensures you make an informed decision. Click here to learn some tips on checking a PC andidate’s references.

Select and Onboard the Candidate: Once you have identified the most suitable candidate, extend an offer of employment. Discuss details such as the start date, duration of employment, and any specific terms or conditions. Provide them with an overview of the tasks and responsibilities they will be assuming. Ensure they have access to the necessary resources and information required to perform the role effectively.

Training and Handover: Prior to starting your maternity leave, dedicate time to train the incoming PA. Provide them with comprehensive guidance, documents or templates used in the EMR, and any necessary training materials.

Maintain Communication: While on maternity leave, you can opt to stay in touch with your temporary replacement as needed. Offer guidance, answer questions, and provide updates on any changes or developments that may impact their work.

Final notes

Preparing for maternity leave as a physician assistant requires careful planning, effective communication, and self-care.

Remember to advocate for yourself, seek support, and set boundaries to achieve a healthy work-life balance.

Maternity leave is not only a time for nurturing your growing family but also an opportunity for personal growth and reflection. Embrace the journey, cherish the moments, and come back to your career with renewed energy and a deeper appreciation for the meaningful work you do. Wishing you a fulfilling maternity leave experience!